Asturias

Inheritance tax Asturias

Asturias has its own inheritance tax regulations as a result of the Spanish State ceding the tax revenue of inheritance and gift tax to Comunidades Autónomas, along with some regulatory autonomy to adapt tax to the particular circumstances of the respective Comunidad Autónoma.

This means that most Comunidades Autónomas have ruled new (and huge) benefits compared to those established by the Spanish State.

While the tax scheme and regime is the same in all parts of Spain, the Comunidades Autónomas took advantage of the given power to fix higher thresholds, or different rates or direct reductions on the amount to be paid (and sometimes all of these) to benefit close relatives of the deceased or disabled people. There are also benefits that help promote local business, farming, etc. as well as in the acquisition of the Comunidad Autónomas’ cultural assets.

However, the Comunidades Autónomas change their regulations quite frequently so it is necessary to check the regulation in force at the time the tax is due (the day of death).

.- In Asturias, unmarried couples have the same rights as married couples provided their relationship had been constituted and inscribed in the Registry of Unmarried Couples in Asturias.

Also, benefits are increased in comparison with State law, for disabled people with a grade over 65% and with existing wealth of under 402.678,11€.

There are large benefits for descendants who are under twenty-one and in some cases this can mean they needn’t pay anything.

The same possibility of paying nothing existed for successions opened prior to 31/12/2016, for descendants over that age, for ascendants and for spouses, if the individual acquisition is less than 150.000 € and his or her existing wealth is under 402.678,11€.

Since the first of January 2017, several changes have come into effect for a beneficiary who is an ascendant, descendant or spouse.

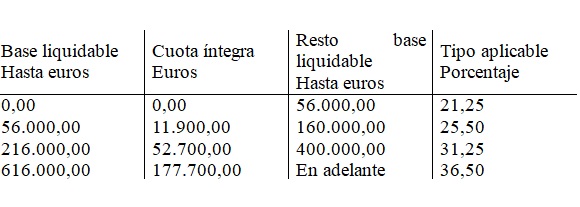

These consist of a reduction of 200.000€ on the Base Imponible for each of them (the amount to be taxed) but with a new, more progressive, higher scale.

In Asturias there are peculiarities related to the reduction of the value of the house which has been the habitual residence of the deceased and in the acquisition of an individual enterprise, professional business or share in a company.

Since the first of June, 2017:

The reduction for acquisitions of ascendants, descendants or a spouse is 300.000 €.

The period to retain ownership of the house which was the habitual residence of the deceased is reduced from ten to three years.

The period to retain ownership in order to keep the reduction in the tax value of the individual enterprise, professional business or share in a company, is reduced to five years.

There is a new reduction of 95% of the money or value of the assets designated, with a limit of 125.000€ (180.000 if the beneficiary is disabled) for the creation of a new enterprise or professional business. It is necessary to contract an employee full time and for at least a year and that the new enterprise is domiciled in Asturias for the following five years.

If the deceased had lived longer in another Comunidad Autónoma than that in which they had their last residence, within this last five year period, that Comunidad Autónoma’s rule will be applied.

If the deceased was a resident in Spain, but for less than five years at the time of death, no Comunidades Autonomas Law will be applicable, BUT Spanish State Law will be applied.

These options for non-residents, are the result of a long process that has evolved in Spanish Law since the European Court of Justice resolution of September 2014.

Any Questions?

successions@inheritancespain.com

Contact us for specific personal advice for your individual case